Foreigners interested in purchasing a property in China are no longer required to stay for at least one year in the country for work or study reasons, before being able to buy a house. Foreigners can purchase as many properties as they want, and at the same time, the rule related to the minimum living time in China has been abolished. Our lawyers in China can help foreigners throughout all the stages of the property purchase process, from the initial search to the drafting of the purchase agreements and the conclusion of the final purchase contract.

| Quick Facts | |

|---|---|

| Can expats buy properties in China? | Yes, foreigners can buy properties in China, except the ones owned by the state. |

|

Legislation for property purchase in China |

Property Law in China |

|

Types of properties you can buy as a foreigner |

residential/ commercial/ industrial properties, etc. |

| Property inspection before purchase (YES/NO) | YES |

| Restrictions for foreigners buying real estate in China |

Cannot buy a second property, cannot rent the purchased property, some citizens must prove they lived in China before acquiring a property and paid taxes |

| Documentation verification made by our law firm in China |

Our Chinese lawyers can verify the history and property documents before purchase. |

| Content of a sale-purchase contract of a property |

– name of the owners and future buyers, – property history and description, – sale price, – payment method, – other legal aspects |

| Real estate tax in China |

1.2% of the value of the property |

| VAT for property purchase in China |

5% on the sale of immovable properties in China |

| Can a lawyer in China represent you with a power of attorney? | Yes, our Chinese attorneys can represent clients with a power of attorney in the sale-purchase process of a property. |

| Possibility to buy without visiting China |

Available option, but it is recommended to collaborate with a Chinese lawyer. |

| Price negotiation |

Depending on the seller |

| Residence permit issued for buying property |

Varied real estate investment options are available for getting residency in China. |

| Buying a property in China through mortgage |

Available option |

| Legal services offered for buying a property in China | We can prepare the sale-purchase contract, verify the property documents, represent clients at the time the agreement is signed in front of the public notary. |

Table of Contents

Who can purchase a property in China?

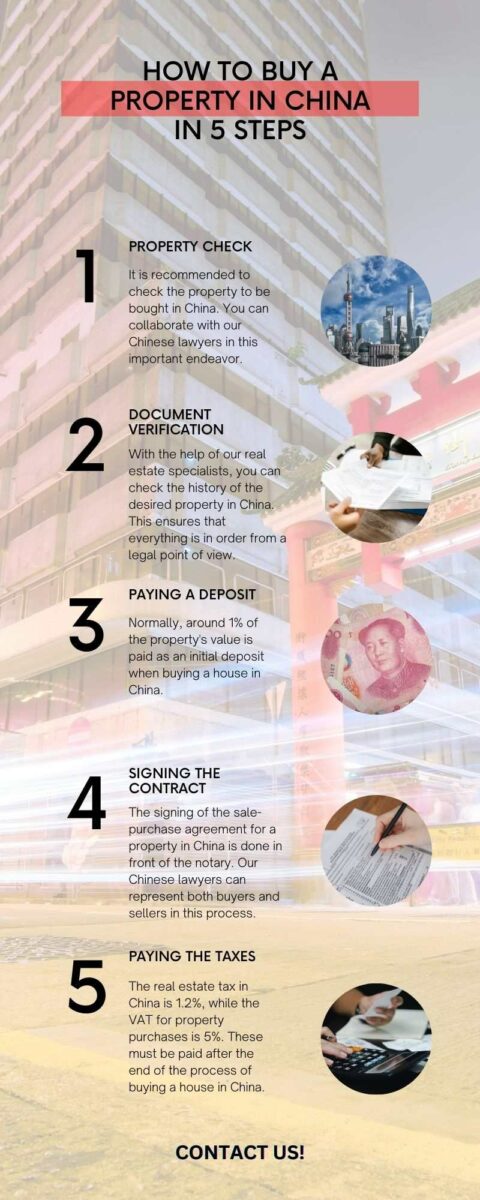

According to the Chinese Property Law, foreigners cannot buy land in China, as the land belongs to the state. Even if some limitations exist, foreigners who work in China or want to relocate here can purchase a property according to their needs and budget. If you want to move here, you can rely on our immigration lawyers in China. Also, you can discover an infographic with information on this subject:

Requirements for foreigners who want to buy properties in China

Although the general requirements have changed, rules may be different in various Chinese regions, like Shanghai, where it is possible to have additional requirements; in this sense, foreign persons who want to purchase a property in Shanghai have to prove that they are married. The legislation applicable in Shanghai also states that a foreigner without a household registration is allowed to purchase only one property. In Beijing, foreign persons would be permitted to buy a house if they pay social security and taxes for five years before the purchase.

The number of houses that can be purchased by a foreigner in China is no longer regulated to a maximum of one. A mandatory rule is that foreigners use the acquired property only for residential purposes and not for renting purposes or other activities. An important aspect is that the new legislation is available for Chinese mainland.

How can foreign investors buy a property in China?

Foreign companies and foreign citizens who want to use a property for other needs than their own must firstly open a company in China. The following requirements need to be considered when wanting to buy a property in China:

- foreign corporations which want to open branches or subsidiaries in China must provide relevant documentation that attests to their legal status;

- a written guarantee that the purchased property will only be used for the needs of the company needs to be provided;

- foreign investors with activities in China are now allowed to purchase a property designated as a housing unit;

- foreigners must live in China for at least one year before purchasing a property.

Our immigration lawyers in China are at your disposal if you want to move and buy a property here. In addition to this, if you are a foreigner who is in China to conclude a marriage by divorce, you are welcome to get in touch with our lawyers. Choosing to divorce your spouse is a major life decision. In addition to this, the decision to engage an attorney is a challenging task; for starters, you must decide who to hire and how much it will cost. For acquiring all this information, you can consult with our lawyers. They can guide you in detail about the proceedings of divorce in China.

A guide to buying a property in China as a foreigner

The foreigners who have been living in China for a while must have witnessed the housing quality in China. If they are trying to get their personal property instead of paying apartment rents, they can contact our attorneys in China for a complete guide. However, here is a general guide provided for foreigners interested in buying a house in China:

- Obtain proof of residency in China: a foreigner first needs to provide proof of his/her residency in China. A person can obtain his/her residency proof from the local Municipal Bureau of Public Security;

- Reach out to a property for sale: foreigners need to find a property for sale in China. They can do this job by themselves or they can also hire a real estate broker;

- Make an offer and create a preliminary agreement: after finding a suitable property for sale, the buyer needs to make an offer to the seller. If the seller accepts that offer, then the buyer and seller will both sign a preliminary purchase agreement and the buyer will pay 1% of the purchase price to the seller;

- Sales and purchase agreement: a sales and purchase agreement has to be prepared (SPA), which should include the selling price, payment of taxes, payment terms and payment installments, consequences if a party breaches the contract, and some other conditions if both parties require any;

- Sign an official contract: after the preliminary contract, the buyer and the seller will sign an official sale contract. As the buyer is a foreigner so the contract must be notarized. The official contract must be registered with the local registry;

- Transfer title is the last step of buying a property in China – the foreign buyer will visit the Deed and Title Transferring Office to transfer the title of the house to his/her name. An inspection of the property title is very important to assure that there are no other encumbrances attached to the property. Foreigners must also obtain a purchase approval from the local Foreign Office, a step which is absolutely necessary so that the government will recognize the purchase in all its rights.

An important aspect for persons interested in purchasing a property in China is that foreign banks can offer various types of loans to foreigners. Real estate due diligence services can be offered by our attorneys so that you can make sure that the property bought is sold in good faith. We remind you that our lawyers can ease the procedures related to immigration to China.

Lease of land-use rights for foreigners

Foreign investors interested in immigration to China can access government-granted land-use rights through the arrangement of agreements with the government. These foreign investors then sign a contract with LRB (Land and Resource Bureau) at the municipal level or with the Chinese government. This way, they are granted land-use rights for a fixed period over a specified plot of land that the state owns. If a foreigner leases a land-use right for residential purposes, the time of lease will be over 70 years.

If the land is leased for commercial or recreational purposes, its lease time will be ended in a maximum of 40 years. If the land is leased by a foreigner for educational, technological, health, culture, sports, or industrial purposes, the grant of such land-use will not be more than 50 years. Some local governments allow foreigners to enjoy land-use lease rights for construction purposes, but this is not usual and it’s only on a trial basis in some areas in China. Commonly, foreign investors lease land-use rights from domestic companies who have already been given these rights from the government. Order 55 stipulates that a foreigner should only use the land for the purposes agreed to in the original grand contract. The registration process of a new leased land-use right must take place within the land administration authority.

If you want to buy a house in China, we are at your service.

Restrictions on buying a property in China as a foreigner

Here are some of the restrictions described for foreigners while purchasing a property in China. The property that a foreigner can own must be residential, but if he/she wants to have a commercial property, then he/she must incorporate it in China. A foreigner cannot be a landlord in China; he/she further needs to pay an initial 30% of the purchase price to the seller in RMB and a 1% deposit if he/she obtains a mortgage.

Can natural persons buy properties in China?

Yes, individuals living in China can purchase houses in this country only if they make proof they have been living here for at least 12 months and paid the imposed taxes in the city they live.

The property purchase procedure in China for Locals

A person seeking to buy a property in China can search for an apartment with the help of a real estate agent or on their own; it is advisable to receive the legal assistance of a Chinese lawyer who is familiar with the local procedure. A preliminary purchase agreement is concluded with the seller and if the terms and conditions are agreed upon, the buyer must make a deposit, which is usually established at 1% of the value of the purchase. The final sale contract needs to be signed by both parties and notarized. Our Chinese lawyers can provide you with further information on the provisions of a purchase contract. The transfer of ownership is performed under the surveillance of the Deed and Title Transferring Office, which will then issue an ownership certificate, testifying the new owner of the property.

The costs related to buying property in china

The notarized contract comprising information about the property purchase, the house insurance, the 0.5% transfer tax, the 7% construction tax, the property tax of 3%, and the notary fees are among the costs related to property purchase in China.

Property prices in China

The average house prices differ from city to city in China. In central Beijing, the prices per square meter conservatively start from 34,000 Yuan. Xujiahui, one of the most expensive areas in Shanghai, has prices from 103,724 to 116,690 Yuan per square meter. The average price of pre-owned apartments in Shenzhen is about 21,000 Yuan per square meter as it is among the biggest property markets in mainland China. Whereas, in Luohuand Nanshan districts, the houses are more expensive. Guangzhou is the third-largest city in China and a new apartment in this city is worth up to 18,500 Yuan per square meter.

Property due diligence in China

Before concluding any final purchase agreement, our Chinese lawyers can help the buyers with specific information on the property. The due diligence procedure for real estate properties in China includes the verification of the following issues:

- tenant information;

- operating/financial information;

- building information;

- any other relevant information.

The financial statements for the property will be thoroughly checked by our team to make sure that there are no mortgages on the house. The information on the building will target specific data, such as reports about the safety of the building, seismic risk, environmental reports or mechanical system reports.

Real estate due diligence for investors

Investors interested in carrying out business activities in China should perform a more complex due diligence procedure, which can include the following:

- verify if the market valuation of the building reflects its true prices;

- a complete set of documents related to the ownership of the building;

- specific lease terms;

- legal guarantees prescribed by the law;

- internal control.

Property Sale in China – Taxes

Selling a property in China may represent a challenge for the seller, in terms of taxes imposed by the Chinese legislation. Our law firm in China can represent your interests, according to the sale you are interested in, but as a client you should know that the following taxes may apply:

- enterprise income tax – applicable for commercial property sale only. The seller must pay a rate of 25% of the enterprise income tax, applied to the profit on the sale, and a 5% business tax,

- land value appreciation tax – applicable at the transfer of real properties and it can vary from 30% to 60% of the appreciation of the property (the increase in value gained by the asset over time). The tax is stated by the GuoShuiFa Circular, applicable since May 2010. Our attorneys in China can provide you with legal documentation upon this Chinese law.

- deed tax – the tax is applicable to the buyer at the moment of the sale, and its value varies between 3% and 5% of the transfer value of the property,

- stamp duty – applicable at the changing of the title of the property.

Our law firm in China can help you submit all the necessary documentation and conclude the purchase agreement, so please do not hesitate to contact us. We can also put you in touch with our partner lawyers in USA if you need legal services in this country.